Maker (MKR) Skyrockets Over 20%, Can Bulls Take Rally Further?

MKR has experienced a meteoric rise of approximately 20% today, according to data provided by Lookonchain, a leading online data platform for blockchain analytics.

What Is Driving The Price For MKR?

The suggested multichain approach of Spark Protocol, a move aiming at extending its reach and implementation over other blockchain networks, can be held responsible for the current rise in MKR price. Apart from this, one of the major players identified is the renowned venture capital firm Andreessen Horowitz, commonly referred to as a16z. Lookonchain’s data reveals that a16z has been making substantial deposits of Maker tokens to the cryptocurrency exchange Coinbase, potentially with the intent to sell. This move has sparked speculation about the firm’s intentions and how it might impact the overall market dynamics.

There are multiple other reasons on the line that are driving the bulls for the MKR token. The introduction of the Optimism Dai Bridge, a layer-2 scaling solution that permits quick and affordable transfers of DAI between Optimism and Ethereum, has given a significant boost to the price.

Recommended Articles

Also, dYdX, a major decentralized derivatives exchange, and MakerDAO jointly announced a collaboration to include DAI as a collateral alternative for margin trading. The combination of Compound, a significant DeFi lending platform, and MakerDAO’s DAI Savings Rate (DSR), which enables users to earn interest on their DAI deposits, has also worked great for the project.

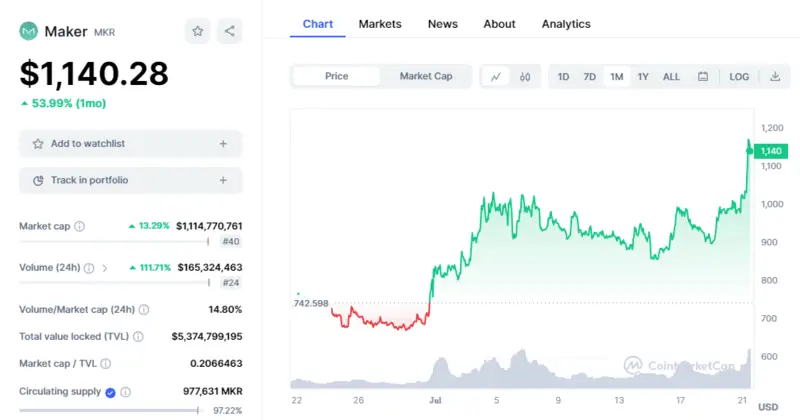

MKR went through two big price increases in June. On July 1, it increased by 21%, rising from $687 the day before to almost $830. On July 3, the token’s value rose by an additional 8%, reaching a 3-month high of $929.87, a feat that hadn’t been accomplished since March. Today, MKR is trading at $1141.87, at the time of writing.

Will The Bulls Sustain?

Indicating the power of buyers on the charts, the RSI curve maintains its position above the overbought region and makes a bullish crossing. Green bars and a bullish crossover on the MACD indicator indicated a promising outlook for the ensuing sessions.

The maker price is revealed to be in an uptrend and to be extending the rise above the initial barrier of $1000. Additionally, the purchasers are becoming more powerful and want an increase.