Bitcoin Leads $168 Million 'Smart-Money' Outflows

According to a new report by CoinShares, the digital asset industry saw a whopping $168 million worth of outflows over the last week, with Bitcoin (BTC) leading the pack. This represented the highest outflows from the sector “since the US regulatory crackdown on exchanges in March 2023.”

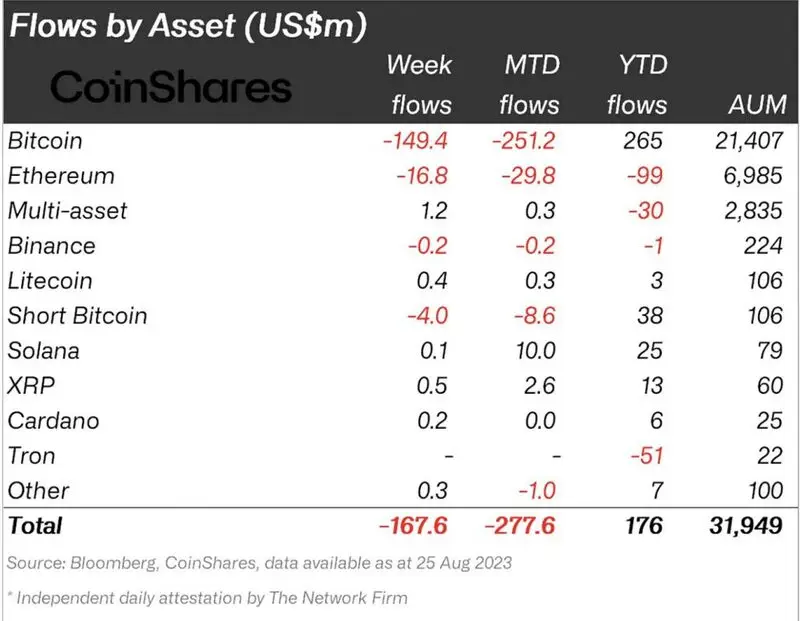

According to CoinShares, BTC was at the center of the outflows, with $149 million. Ethereum (ETH), on the other hand, saw outflows worth $16.8 million. On a month-to-date basis, Bitcoin saw outflows of $251.2 million, while Ethereum saw outflows of $29.8 million. The total outflows for the month of August now sit at $278 million. Meanwhile, XRP and Litecoin (LTC) saw minor inflows of $0.5 million and $0.44 million, respectively.

Also Read: Argentina is Adopting Bitcoin Faster than El Salvador: Ark Invest

However, the report noted that fund flows remain positive for BTC on a yearly basis, with $265 million.

Additionally, CoinShares mentioned that the negative sentiment is global as the “outflows were spread across most geographies.” Germany and Canada saw most of the action, with outflows of $68 million and $61 million, respectively.

Why did Bitcoin see such a massive outflow of funds?

According to CoinShares, the negative sentiment could be attributed to “the increasing acceptance that a spot-based ETF for Bitcoin in the US is likely to take longer than many expect.”

Also Read: 7 Bitcoin ETF Deadlines Are Approaching In a Week: Here’s When

The U.S. Securities and Exchange Commission recently delayed the second deadline for 21Shares and ARK Invest’s BTC ETF decision. The first deadline for seven different spot Bitcoin (BTC) ETFs is within the first week of September. Many believe that the SEC will probably delay these as well. There is a possibility that we will not have a decision from the SEC regarding the ETF applications until early 2024.

Comments

Post a Comment