Bitcoin price drops as SEC delays decision on Bitcoin ETF, offering new trading opportunities

The SEC’s hesitation to approve the first Bitcoin ETF is putting pressure on the Bitcoin price, which is painful for crypto holders. Thanks to TradeSanta’s automated trading tools connected to spot and futures trading platforms, traders can reduce risks and take advantage of downturns.

Bitcoin had some attempts earlier this year to consolidate above the $30,000 mark, but it failed to do so. By the end of the year, the cryptocurrency may continue to trade below this psychological level, and one of the reasons behind the constant bearish pressure is the Securities and Exchange Commission’s (SEC) prolonged hesitation to approve a spot Bitcoin exchange-traded fund (ETF).

The SEC has postponed its decision on Bitcoin (BTC) ETFs, impacting numerous applicants, including BlackRock, a key player that encouraged other institutions to reapply.

Who applied for a Bitcoin ETF with the SEC?

Many asset managers, brokers, index fund providers and other institutions are seeking the green light for a Bitcoin ETF, which would bring more institutional and retail money into the crypto space. Here are the main applicants:

- BlackRock — The world’s largest asset manager, with $8.6 trillion under management, sent its application for a spot Bitcoin ETF in mid-June, indicating Coinbase would be its main data provider and crypto custodian. The filing boosted the Bitcoin price at the time, as BlackRock is probably the most influential player in the financial markets. The SEC accepted BlackRock’s application for review one month later.

- Fidelity — Financial services giant Fidelity is one of the companies that reapplied after BlackRock. The asset manager first applied in 2021 but was rejected. In July of this year, it refiled for its Wise Origin Bitcoin Trust to be turned into an ETF.

- VanEck — VanEck has been seeking the nod for a Bitcoin ETF since 2018, being one of the earliest applicants. After previously withdrawing its application on its own, the asset manager rejoined the Bitcoin ETF race in July 2023.

- ARK Invest — Investment management firm ARK has been waiting for the SEC’s approval for its ARK 21Shares Bitcoin ETF since June 2021.

- Invesco and Galaxy Digital — Investment management firm Invesco joined forces with Galaxy Digital, seeking approval for the Invesco Galaxy Bitcoin ETF. This would be an ETF “physically backed” by Bitcoin, with Invesco as the sponsor.

Other institutions planning to launch a Bitcoin ETF include WisdomTree, Valkyrie Investments, Bitwise and GlobalX.

At the end of August, the SEC delayed its spot Bitcoin ETF decision for all applicants.

How does the SEC’s delay affect the Bitcoin market?

Bitcoin was hovering above $28,000 at the end of August, trying to retest the resistance at $30,000. However, the SEC’s delay in its decision on all Bitcoin ETF applications discouraged the Bitcoin market, pushing the price down until it found support near $25,000.

In mid-September, the bearish pressure further extended, with the BTC price breaking below the $25,000 mark for the first time since mid-June, when BlackRock fueled the rally with its SEC filing.

Source: TradingView

How to trade during bearish markets?

While bearish markets scare many Bitcoin holders, active traders can seek advantages even during such harsh conditions by opening short positions. To make this process more efficient and take emotions out of the equation, crypto traders can use trading bots and automation tools from TradeSanta. This platform offers an array of algorithmic strategies that can work well, including during bearish trends.

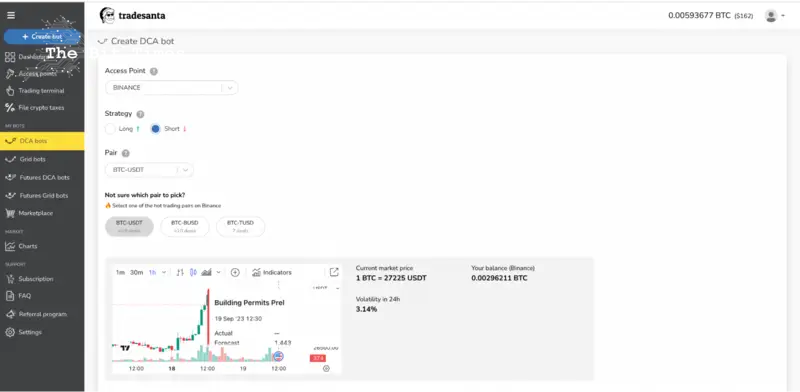

TradeSanta offers a versatile approach to trading that caters to both novice and experienced traders, allowing them to begin their trading activities based on their individual skills and preferences. Traders have three different ways to begin their journey: they can choose from a number of pre-designed strategies available in the marketplace for mirror trading, use preset algorithms, or opt for the customization option to create their own unique bots from scratch. This flexibility is especially beneficial for those looking to automate short strategies at specific price levels. Most importantly, TradeSanta’s short strategies are equipped with essential risk management controls.

Source: TradeSanta

TradeSanta offers its own trading venue to ensure a user-friendly experience. The platform also integrates with major exchanges like Binance, Coinbase, Kraken, Huobi, Bybit and more via API keys, eliminating the need to move funds. Moreover, TradeSanta’s trading terminal allows trading spot markets manually on different exchanges at once.

Source: TradeSanta

Capitalizing on downtrends becomes straightforward with TradeSanta. Designed for over 100 cryptocurrencies, traders can tactically set up any coin if it is traded on the exchange. For instance, if Bitcoin starts to lose ground, traders can open a short position on the BTC/USDT pair, with the intent of selling Bitcoin at a higher price and then buying the same amount back but at an even lower price. The bot automatically acquires Tether (USDT), manages profit orders and repurchases Bitcoin at the targeted dip, eventually, a trader gets back the same amount of BTC plus profit in USDT.

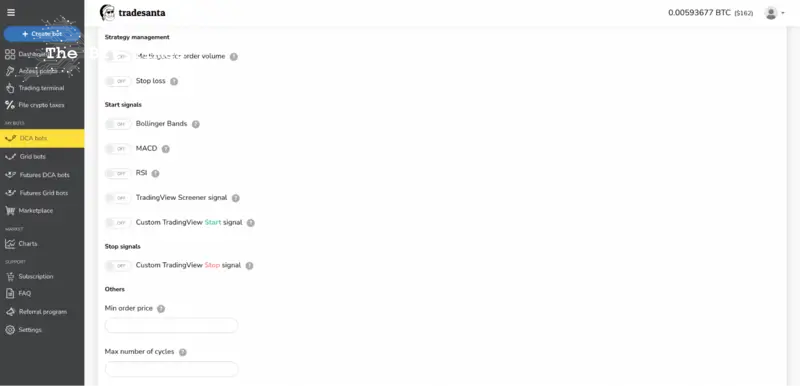

Beyond bots, TradeSanta offers technical analysis tools, which help crypto traders better recognize trends and understand market sentiment.

TradeSanta assists not only short traders with leveraging market downturns but also helps long traders minimize risks. Thanks to its stop-loss and trailing stop-loss features, bearish trends don’t take traders by surprise, minimizing potential losses and improving crypto portfolio management. Here is what you should consider for a proper stop-loss:

- Calculate your risk/reward ratio to align with your risk tolerance.

- If trading based on support and resistance, place your stop-loss below the most recent support level.

- Consider using the moving average method, setting stop-losses below longer-term averages.

Additionally, TradeSanta enables users to enhance their trading strategies through copy trading by replicating successful traders’ strategies for maximum profitability.

User feedback and statistics indicate that TradeSanta’s risk management tools have been effective in helping users minimize losses and navigate volatile market conditions.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Comments

Post a Comment